hawaii general excise tax id number

If you have quetions about the online permit application process you can contact the Department of Taxation via the sales tax permit hotline 800 222-3229 or by checking the permit info website. 37-1 General Excise Tax GET and Tax Announcement Nos.

Hawaii Business License License Search

Perfect answer Hawaii SalesTax IDs that are issued after the modernization project begin with the letters GE and are followed by 12 digits.

. Examples of these are GE lines. Tax accounts that have been upgraded will be distinguished by a new Hawaii Tax ID starting with a two-letter account type identifier and 12 digits. General Excise Tax License Search.

For example GE numbers are 1000 9999 9999-01. GE-999-999-9999-01 All sales tax related account IDs begin with the letter GE to reflect the tax type. How Do I Find My Hawaii General Excise Tax Number.

For example if you have incorporated your llc you may need a new hawaii tax id number. It offers a number of online resources for consumers including licensee status and licensing complaints tax and business registration and other educational materials. In sales tax related account IDs the letter GE indicates the tax type.

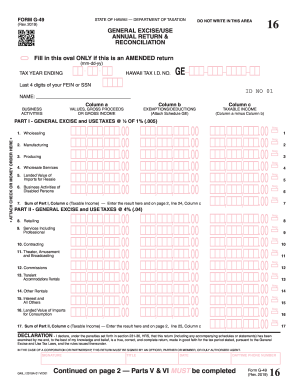

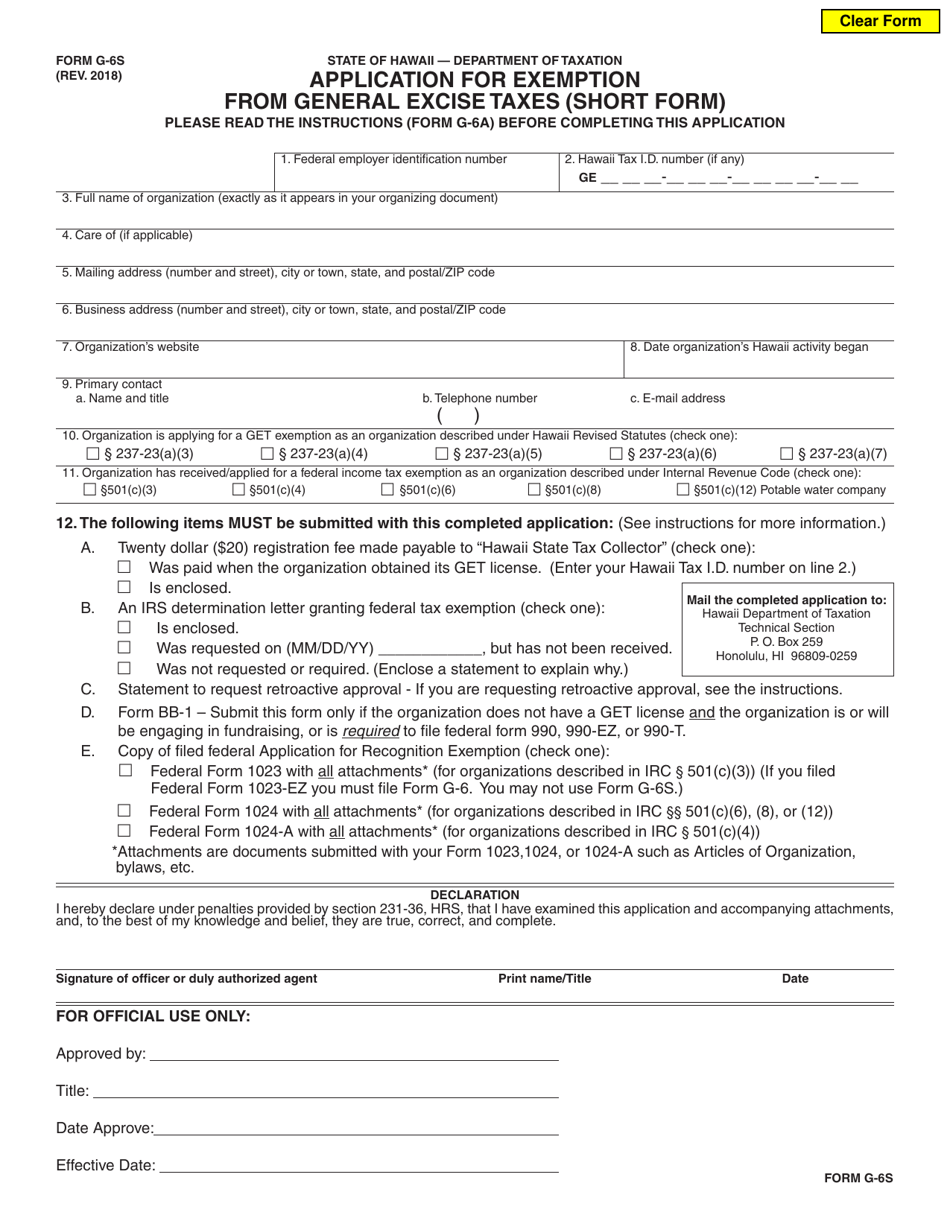

The tax rate is 015 for Insurance Commission 05 for Wholesaling Manufacturing Producing Wholesale Services and Use Tax on Imports For Resale and 4 for all others. 16 Can I add tax licenses to my Hawaii Tax ID. The General Excise Tax license is obtained through the Hawaii Department of Taxation as a part of applying for a Hawaii Tax Identification Number.

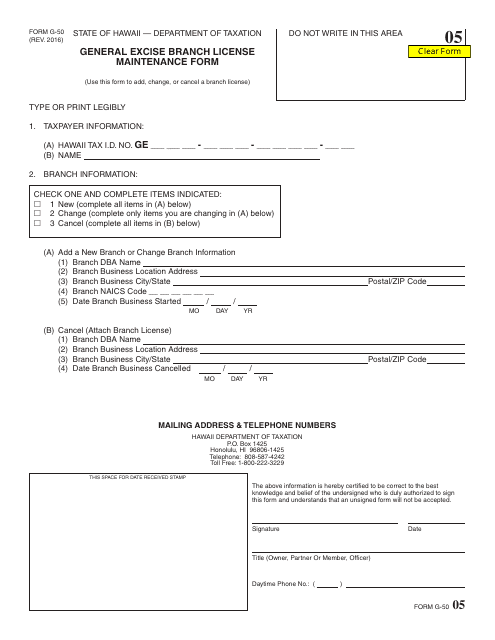

A sales tax related ID with a general excise letter is displayed. Hawaii Sales Tax IDs have the letters GE beginning the first line and will be followed by 12-digits after the project is completed. If you have more than one DBA complete Form G-50 General Excise Branch License Maintenance Form to get a branch license for each DBA you use.

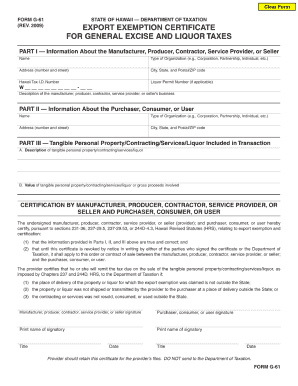

Check on whether a business or individual has a general excise tax license with the State of Hawaii Department of Taxation. Old Corporation cannot transfer its license to New Corporation. Apply Online Now with Business Express.

The Hawaii SalesTax ID card that is issued after the modernization project with a 13 letter heading is titled GE. Check out the rest of this guide to find out who needs a General Excise. The GE name for example would be999-99-9999-01.

3 rows Old Hawaii Tax ID Number Format New Hawaii Tax ID Number Format. This process can also. How Do I Find My Hawaii General Excise Tax Number.

Examples are GE numbers 9999-9999-01 and 99999-000-02. It has been noted that sales tax account IDs start with the letter GE. Hawaii SalesTax IDs that are issued after the modernization project begin with the letters GE and are followed by 12 digits.

For online applications an email is sent to you with the general excise identification number within three to five days and after this process you should receive your license within a week. In order for an ID reflecting your sales tax-related account to begin with the letter GE you need to identify the. How Do I Find My Hawaii General Excise Tax Number.

An extension for an additional two 2 years may be. The GET is similar to a sales tax but is actually a privilege tax based on the gross income of most business activities in the State of Hawaii. Those SalesTax IDs issued after the modernization project begin with GE and the last four digits are in alphabetical order.

Not just the pages but even the text within all the Microsoft Word Excel and Adobe PDF files that we have posted over the years. A common example would be the GE numeric code. Account IDs that contain sales tax information beginning with GE is to indicate that that the form contains tax form.

When a sale conveyance or other transfer of all or a substantial portion of another business occurs the seller must obtain a certification from the Department on Form G-8A Report of Bulk. If you have a Hawaii Tax ID you can add tax licenses such as employers withholding transient accommodations cigarette. GET is levied on gross receipts or gross income derived from all business activities in the State.

The tax rate is 015 for Insurance Commission 05 for Wholesaling Manufacturing Producing Wholesale Services and Use Tax on Imports For Resale and 4 for all others. You can easily acquire your Hawaii General Excise Tax GET License online using the Business Express website. This excise tax is for the privilege of doing business in the State of Hawaii.

Our old system assigned a Hawaii Tax ID starting with the letter W followed by 10 digits. Perfect answer Useful How Do I Find My Hawaii General Excise Tax Number. Individual estimated 02230.

There is a General Excise designation assigned to all sales tax-related. After the modernization project Hawaii SalesTax IDs are issued which are issued after the modernization project begin with the letters GE and are followed by 12 digits. With Hawaii SalesTax IDs issued after the modernization project your first number will be GE followed by the subsequent 12 letters.

For more information see Tax Facts No. To learn more about the differences between the GET and sales tax please see Tax Facts 37-1 General Excise Tax GET. Search with Google This custom search allows you to search the entire Department of Taxations Website.

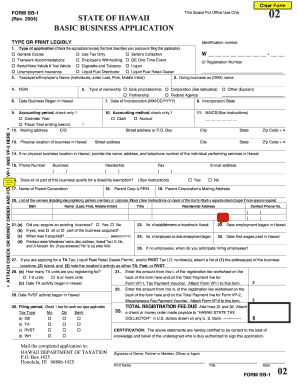

Branch licenses are free. How Do I Find My Hawaii General Excise Tax Number. Hawaii requires all businesses to complete package BB1 with a collection of applications and registration forms that include the General Excise Tax GET license application.

The general excise tax and obtain its own Hawaii Tax Identification Number. See Hawaii Tax ID Number Changes for more information. Once this application is completed you will receive a registration number and an official GET license that will allow you to start doing business in Hawaii.

Sales tax IDs issued to Hawaii residents in the wake of the Hawaiis modernization project are unique in their 12-digit letters beginning with GE. Hawaii General Excise Tax Sales The State of Hawaii does not impose a sales tax on the buyer but a general excise tax GET is levied upon the seller. Here is a sample GE code.

If you are stopping your business temporarily you can request to put your general excise tax transient accommodations tax rental motor vehicle tour vehicle and car-sharing vehicle surcharge tax and withholding tax licenses on hold using Form L-9An account may be put on Inactive status for up to two 2 years. General Excise Tax GET Information Department of Taxation tip taxhawaiigov. You should not enroll in AutoFile using a Hawaii Tax ID that begin with abbreviations for other tax types such as CO.

2006-15 General Excise Tax GET and County Surcharge Tax CST Visibly Passed on to Customers 2018-14 Kauai County Surcharge on General Excise Tax and Rate of Tax Visibly Passed on the Customers 2018-15 Hawaii.

2015 Form Hi Dot G 49 Fill Online Printable Fillable Blank Pdffiller

Form G 50 Download Fillable Pdf Or Fill Online General Excise Branch License Maintenance Form Hawaii Templateroller

Hawaii General Excise Tax Everything You Need To Know

Al Falaah Fill Online Printable Fillable Blank Pdffiller

Hawaii State Tax Golddealer Com

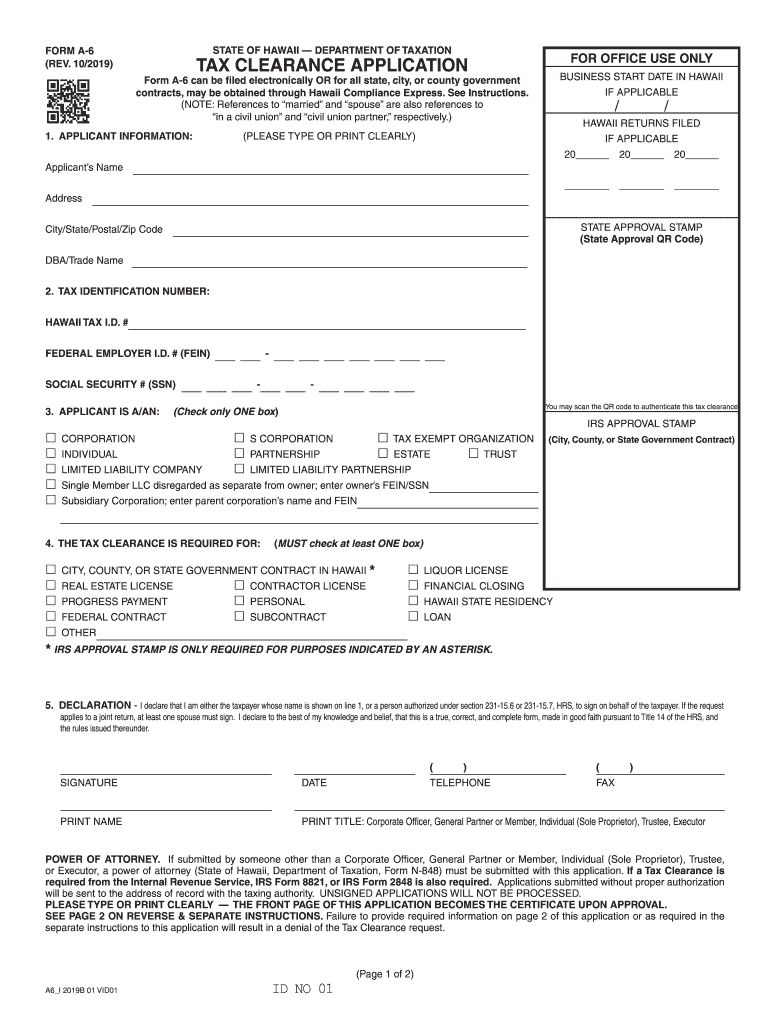

Tax Clearance Certificates Department Of Taxation

Special Enforcement Section Ses Overview Department Of Taxation

Michael V David Dba Klu Consulting

Hi Dot A 6 2019 2022 Fill Out Tax Template Online Us Legal Forms

Form G 6s Download Fillable Pdf Or Fill Online Application For Exemption From General Excise Taxes Short Form Hawaii Templateroller

22 Printable Ntee Code Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

Form Gew Ta Rv 5 General Excise Use Employer S Withholding Transient Accommodations Rental Motor Vehicle And Tour Vehicle Surcharge Application Changes Rev 2009

County Surcharge On General Excise And Use Tax Department Of Taxation

2015 Form Hi Dot G 45 Fill Online Printable Fillable Blank Pdffiller